Most trading activities in the foreign exchange market occur between institutional traders, i.e., people who work for banks, fund managers, and multinational corporations. Take a closer look, and you’ll see regular individuals who mainly use the market to speculate and day trade. They indeed represent a relatively small percentage of all the Forex trading volume, but it’s far from negligible.

Over the past couple of years, online trading platforms have broadened the market for traders. The FX market brings in more traders thanks to the minimum deposit requirement, 24/7 trading, and access to high amounts of leverage. Lower leverage makes better sense if you’re a beginner. Low spread (low commission) Forex brokers offer numerous tools to suit your trading style. All you need is a phone and an app to get started.

Doing it from your notebook or PC will save you time, not to mention that it’s simpler. If you have your strategy fully completed, you can trade on your mobile device. Owing to innovations in technology, you can now trade on the go. As long as you have a good Internet connection, there’s nothing to worry about. Keep on reading to find out everything there is to know about trading Forex on mobile.

Select The Right Mobile Device

You can manage Forex trades regardless of your location when trading on the go. You’re not bound to your desk. You can buy and sell currencies at any time you want while assessing your profit and losses. Put simply, you’re in control. If you have the know-how of investing, you’re good to go. If you’re looking forward to venturing into the world of FX trading via mobile, you’ll need a good smartphone.

It’s not a good idea to go lower than 2019 when it comes to the model’s release date. Additionally, give careful thought to these aspects. As you can imagine, not all smartphones are equal for trading.

It All Comes Down to Android Vs iOS

The most popular operating systems are Android and iOS. There are other options, such as Windows OS, Blackberry OS, and BADA. The two most significant mobile operating systems (Android and iOS0 dominate the market. Android has a more extensive user base due to the fact that it’s available various manufacturer devices, including HTC, Motorola, Samsung, etc., iOS only runs on Apple devices.

The question now is: Which is better for you? iOS wins when it comes to privacy. You can opt out of apps tracking you across your phone. Plus, you get faster software updates. When a new iOS version is released, it’s available to everyone on the same day. Nonetheless, the choice is up to you.

Screen Size Matters

The larger the screen, the more you can see and do. You can easily set up successful trades with a larger smartphone screen size. It’s good to buy a 5.5-inch phone; anything under 5.5 inches is too small. The display is large, so it allows you to trade comfortably. As far as the phone is concerned, it’s compact enough to fit in your hand. You can experiment with smartphones of various makes, such as Samsung, Apple, Google, Huawei, and so on.

You Don’t Want a Battery That Does Mid Trade

A bigger battery means not having to worry about charging the phone all the time. Imagine what it would be like to have your phone die on you in the middle of a trade. The issue with smartphones is that they have a limited amount of battery life. That’s because consumers prefer lighter phones over chunkier, heavier devices. The design of the mobile device eats away at the battery.

Examples of long-lasting phones include iPhone 13 Pro, Samsung Galaxy A52, and Moto G Power. Anything above 10 hours is good for trading. If you want to maximize the battery of your phone, watch out for power-hungry apps like Facebook Messenger or WhatsApp. If you’re constantly on the go, it would be best to use a portable charger. Also, you’ll want to turn off your GPS. Enabling GPS uses extra power except when location services are used.

Explore Trading Platforms at Different Brokerage Firms

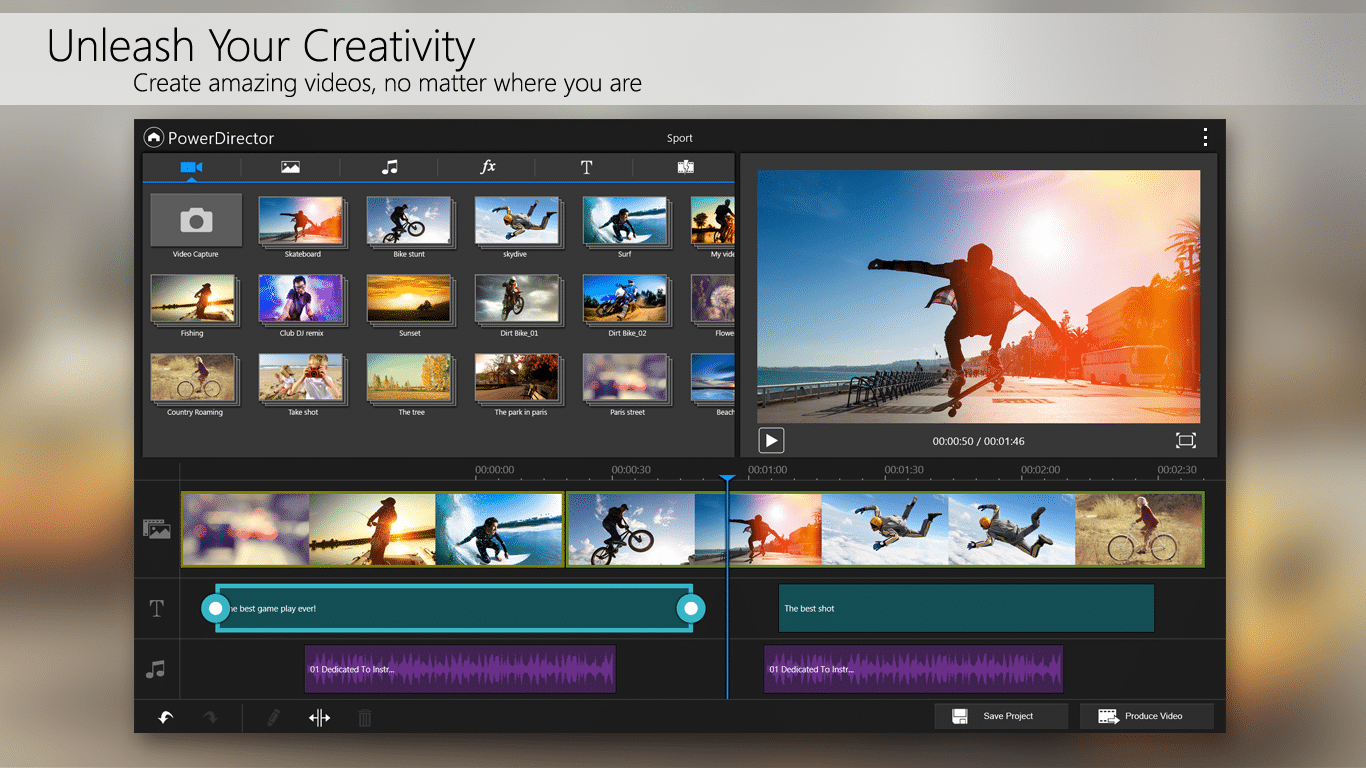

Choosing the right broker platform is essential. The interface provided by the broker offers access to the foreign exchange market. It can be an online, web-based portal or a mobile app. As long as the platform you sign up with adheres to the laws and regulations governing the industry, you can have peace of mind. A mobile app makes it very easy to view your account, position, and balances.

If you’re not sure if the chosen mobile platform is too sophisticated or not, sign up for a demo account. If you plan on trading Forex full-time, select an app that meets your needs. Proprietary platforms are superior to options such as MetaTrader. It’s developed with user experience in mind, so everything that’s too complex is hidden from the view. The right piece of software is essential for the effective and precise execution of trade orders.

Given the abundant resource availability, you’re spoilt for choice. Evaluate the content, trading tools, and educational materials available from brokers. Equally, take into account the number of available markets. For instance, some brokers offer a small percentage of currency pairs yet make available CFDs, commodities, and so forth.

Get a demo account if you’re not ready to trade under real market conditions. You can avoid putting your capital at risk. On the flip side, you get access to real-time market data, trade with virtual currency, and obtain the latest trading insight.

Final Thoughts

You can stream news and pricing information, which is very useful if you’re a newbie. Plus, you have access to various tools, which help you analyze the market. These days, several brokerages are incorporating AI on mobile trading apps. You can use the AI predictions to create long-term strategies. The predictions are accurate, and the accuracy only gets better with time. If you’re comfortable applying strategies and doing analysis on your phone, you can trade Forex on the go.