Welcome to the ultimate guide on maximizing the benefits of Lowe’s Business Advantage. The home improvement industry has witnessed a significant boom, driving many to explore the benefits of a Lowe’s credit card. If you’re new to this and wondering about the Lowe’s credit card login process, you’ve come to the right place. In this guide, we’ll walk you through the steps and provide valuable insights into managing your Lowe’s credit card effectively.

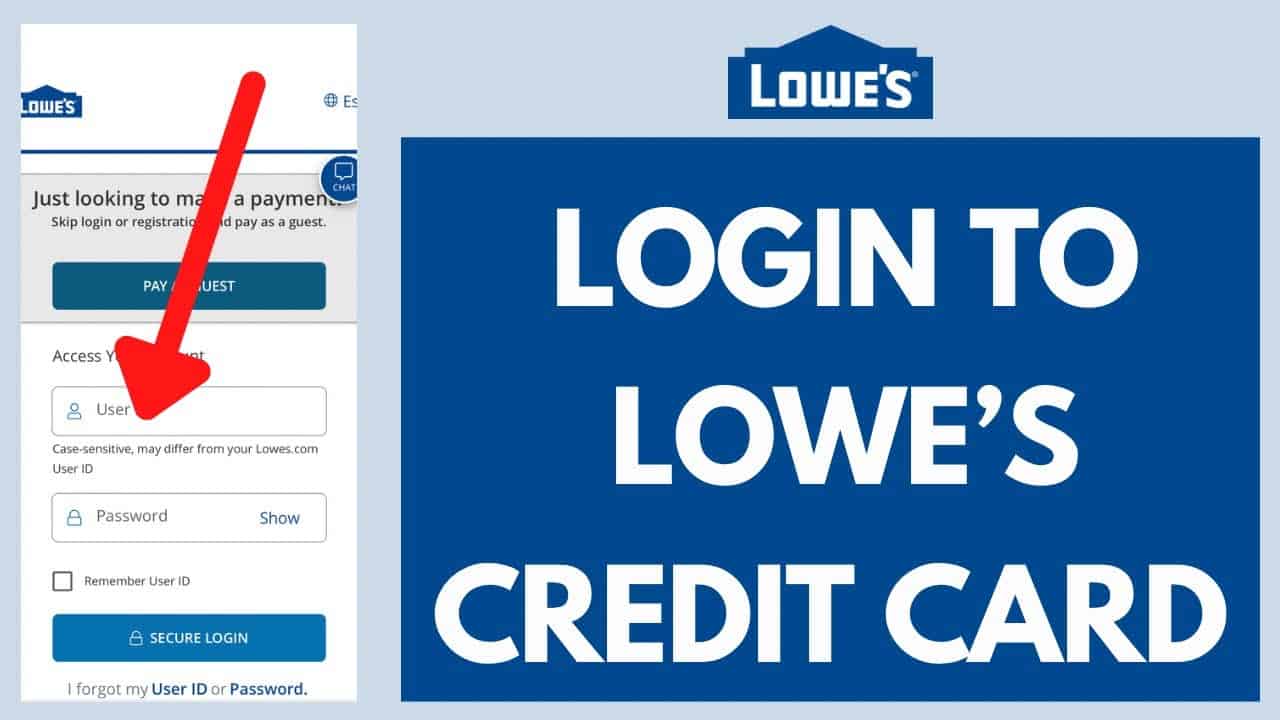

How to Login to Lowe’s Credit Card

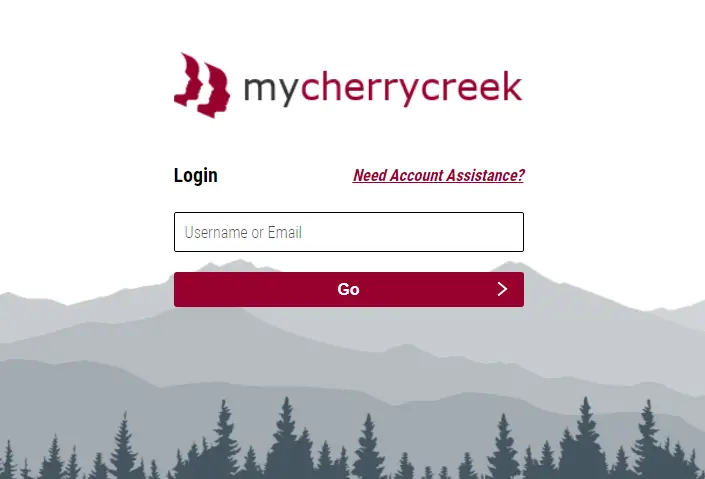

1. Head to the login portal

Visit the Lowe’s credit card login portal by typing https://lowes.syf.com/login/ in your search bar or just hit the link.

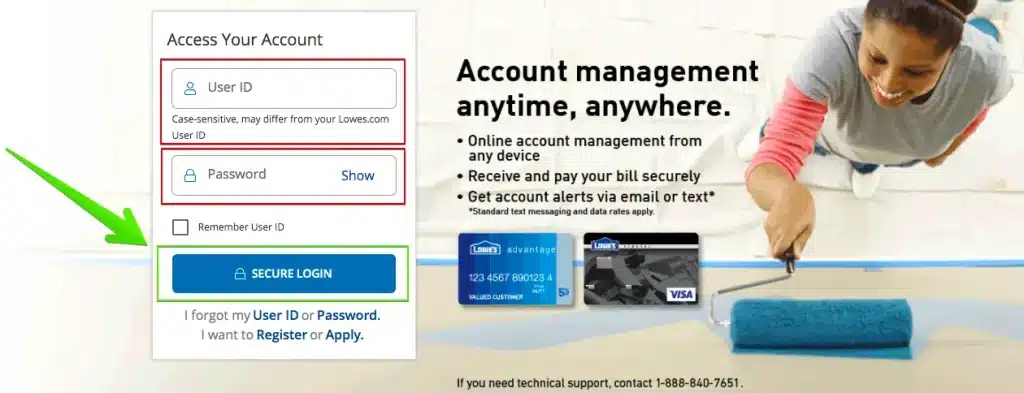

2. Enter Username & Password to Login

Input the username and password you created during activation. Tap “SECURE LOGIN,” and voila! You’re on the homepage, ready to explore.

Forgot Your Login Credentials?

- Click “I Forgot my User ID” or follow a streamlined password reset process.

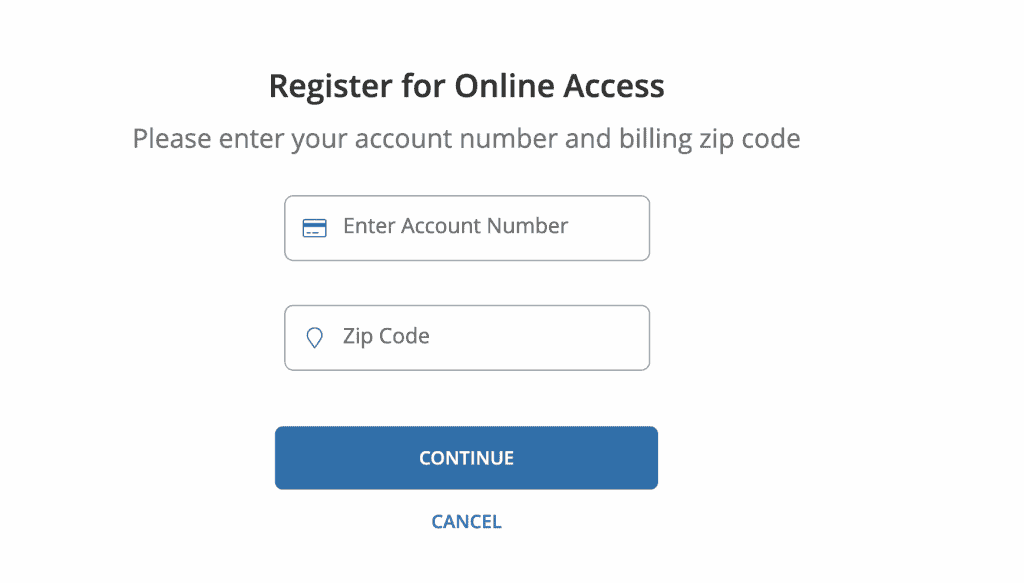

First Time Logging In

For first-timers, activating your online account is a breeze.

- Below the login fields, click “I Want to Register.”

- Enter account details and zip code.

- Create a Username and Password for future logins.

Now, your Lowe’s credit card login is primed for action.

How to Solve Lowe’s Synchrony Bank Card Login Issue?

1. Solve Lowe’s Credit Card Login Issue In Edge

Users facing difficulties with Microsoft Edge can follow these steps:

- Open Edge, click three dots.

- Select “Settings” > “Reset Settings.”

- Choose “Restore settings to default values.”

- Restart and try logging in again.

2. Resolving Lowe’s Credit Card Login Problems Associated with DNS Errors

Address DNS errors with these steps:

- Ensure a strong internet connection.

- Clear browser’s cache and cookies.

- Disable VPN or proxy.

- Try an alternative browser.

3. Troubleshooting Steps for Lowe’s Credit Card Login Issues Due to Incorrect Login Credentials

If facing login issues due to incorrect credentials:

- Verify username and password.

- Use “Forgot Password” link for reset.

- Contact customer support if issues persist.

Manually Uploading Transactions in QuickBooks Using Lowe’s Synchrony Account Credentials

For QuickBooks users, importing transactions manually requires Lowe’s card login. Follow these steps:

- Access Banking menu in QuickBooks.

- Select “File to Upload Transactions.”

- Choose Lowe’s Advantage account.

- Follow on-screen instructions for import.

Steps for Making a One-time Online Payment with Synchrony Bank Lowe’s

Making a one-time payment online is straightforward:

- Sign in to Lowe’s Synchrony Bank account.

- Locate Lowe’s credit card account.

- Click “Make a Payment.”

- Specify payment details and method.

- Review and click “Submit Payment.”

Contacting Lowe’s Synchrony Bank for Assistance with Lowe’s Card Login Issues

Facing persistent login issues? Reach out to Lowe’s Synchrony Bank customer service:

- Dial customer service number on your card.

- Follow prompts to connect with a representative.

- Provide required information for assistance.

Paying Your Lowe’s Credit Card Bill

Online QuickPay Option

Synchrony Bank’s QuickPay lets you pay without logging in. Simply enter your invoice/account number and pay instantly.

Through the Lowe’s Mobile App

The Lowe’s App is a game-changer:

- Pay with a scan in-store.

- Make purchases, track rewards, and view statements hassle-free.

- Report a lost or stolen card directly through the app.

Pay In-Store

For in-store payments, head to the Customer Service desk. It’s convenient, efficient, and can be done while making other purchases.

Types of Lowe’s Credit Cards

Lowe’s caters to diverse needs with various credit cards:

Individual Customers

Lowe’s Advantage Card

- 5% off everyday or 6-month special financing.

- Exclusive promotions and zero annual fee.

Contractors or Business Owners

Introducing Lowe’s Business Rewards Card

Convenience and Cash Back

The Lowe’s Business Rewards Card offers the convenience of use not only at Lowe’s but also at all locations accepting American Express cards. Earn cash back on every eligible purchase, starting with an impressive 5% cash back for the first 6 months.

0% Interest for 60 Days

Take advantage of zero percent interest for 60 days on new purchases. Note that minimum monthly payments are still required during this promotional period.

Lowe’s Commercial Account Advantages

Instant Savings

With Lowe’s Commercial Account, save 5% on eligible in-store and online purchases at Lowes.com. This instant savings feature helps you stay within your budget effortlessly.

Comprehensive Transaction Details

Access detailed transactions, SKU-level specifics, purchase order or job names, and authorized buyer information. This ensures improved transparency and efficient record-keeping.

Extended Terms with Plus Extended Terms

Plus Extended Terms provide flexibility, allowing you two billing cycles to pay for your acquisitions. This feature helps you align payments with your business cash flow conveniently.

PreLoad Plus Mastercard®: Your Smart Business Solution

No Credit Check, No Monthly Fees

Bid farewell to credit checks and monthly fees with the PreLoad Plus Mastercard®. It’s a hassle-free financial tool for your business needs.

Versatile Spending

Use this card not only at Lowe’s but also at any location accepting Mastercard®, providing the freedom to make purchases where you need them.

Automatic Rebates

Enjoy automatic rebates on fuel, dining, and travel expenses through Mastercard® Easy Savings™, helping you save on everyday business costs.

Earn 5% Cash Back at Lowe’s

With the Lowe’s Business Rewards Card, seize the opportunity to earn an enticing 5% cash back on eligible purchases at Lowe’s during the initial 6 months. This 5% cash back is in addition to the 2% cash back for every dollar spent on qualifying purchases at Lowe’s.

Lowe’s Business Rewards Points

The cashback accumulates in the form of Lowe’s Business Rewards points, which can be redeemed for statement credits or select gift cards, enhancing your savings.

Eligible Purchases and Redemption

Eligible purchases cover goods and services, excluding returns and other credits. Redeem your earned points for additional savings.

Lowe’s Lease to Own

A no-credit-check option with flexible payment plans and an instant decision. Apply online, by text, or in-store.

Lowe’s Makes It Easy

For those “oh-no-I-forgot-my-credentials” moments, Lowe’s ensures a smooth recovery:

- Return customers can log in traditionally.

- First-timers can register using card details and zip code.

Now, Lowe’s credit card management is a breeze. Whether you’re a DIY enthusiast or a seasoned contractor, Lowe’s has tailored solutions for everyone.

10 Questions and Answers:

- Q: Can I pay my Lowe’s credit card bill without logging in? A: Yes, use the QuickPay option with your invoice/account number.

- Q: Are there different types of Lowe’s credit cards? A: Absolutely, catering to individual customers and business owners.

- Q: How do I apply for Lowe’s Lease to Own? A: Apply online, by text, or in-store for a quick decision.

- Q: Can I make in-store payments without making a purchase? A: Head to the Customer Service desk for bill payments.

- Q: Is there an annual fee for Lowe’s Advantage Card? A: No, it comes with zero annual fees.

- Q: What benefits does Lowe’s Business Credit Card offer? A: Discounts on purchases, separate billing, and more.

- Q: How can I report a lost or stolen card through the Lowe’s App? A: Navigate to the app and use the provided option for lost or stolen cards.

- Q: Can I add my Lowe’s Credit Card to my iPhone Wallet? A: Yes, the Lowe’s Mobile App allows you to add your card to your iPhone Wallet.

- Q: What’s the advantage of the Lowe’s Lease to Own Program? A: No-credit-check option with flexible payment plans and an instant decision.

- Q: How do I recover my login credentials if I forget them? A: Follow the easy steps provided on the Lowe’s login portal.