Hey there, money mavens! Ever found yourself Googling payday loans eLoanWarehouse at 2 AM, sweating over bills? You’re not alone in this financial rodeo. Let’s dive into the world of eLoanWarehouse and see if it’s your golden ticket or just fool’s gold.

| Key Takeaways |

|---|

| eLoanWarehouse offers quick online loans up to $3,000 |

| Repayment terms stretch from 6 to 12 months |

| Interest rates are sky-high compared to traditional loans |

| Application is speedy, often with same-day approval |

| Proceed with caution – debt traps are real! |

What’s eLoanWarehouse All About?

Picture this: eLoanWarehouse is like that friend who’s always ready to spot you some cash. Sounds great, right? Well, let’s not get ahead of ourselves. Here’s the lowdown:

- Borrow anywhere from $300 to $3,000

- Pay it back over 6 to 12 months

- It’s all online, so you can do it in your PJs

Convenient? You bet. But remember, convenience often comes with a price tag.

The Good, The Bad, and The “Oh Boy”

The Good

- Lightning Fast: Cash in your account quicker than a pizza delivery.

- Flexible-ish: Longer to pay back than your typical payday loan.

- Credit Score Friendly: They’re not too picky about your financial past.

The Bad

- Interest Rates from Mars: We’re talking astronomical figures here.

- Debt Quicksand: Easy to get in, tough to crawl out.

- Sneaky Fees: Always read the fine print, or it’ll read you!

The “Oh Boy”

Let’s get real for a sec. This convenience can cost you big time. It’s like using a credit card to pay off another credit card – a slippery slope that leads straight to Debt Mountain.

Is eLoanWarehouse Your Only Hope?

Whoa there, partner! Before you jump on the eLoanWarehouse bandwagon, let’s explore some other trails:

- Credit Union Pit Stop: Often cheaper and more understanding.

- Peer-to-Peer Lending Lane: Check out Prosper or LendingClub.

- Negotiate Boulevard: Sometimes, a heart-to-heart with your creditors works wonders.

- Side Hustle Highway: Ever thought about driving for Uber or selling on Etsy?

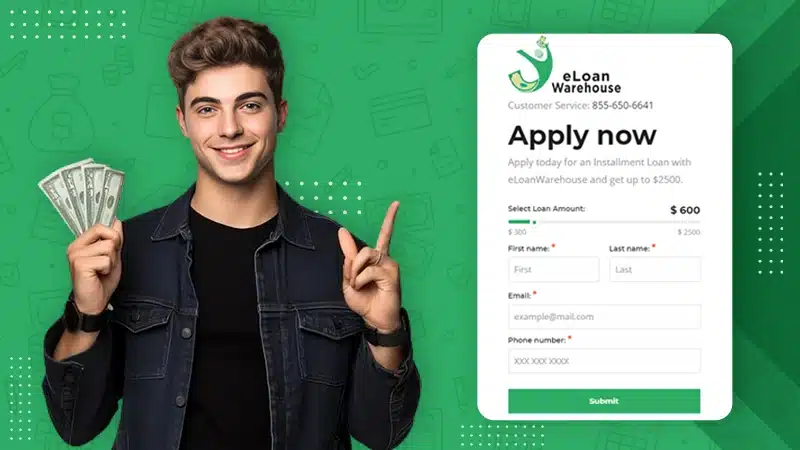

Applying: Easy as 1-2-3 (But Watch Your Step!)

So, you’ve decided to give eLoanWarehouse a whirl. Here’s how it goes down:

- Visit Their Digital Digs: Head to eLoanWarehouse.com.

- Spill the Beans: Fill out their form with your deets.

- Play the Waiting Game: Usually, it’s shorter than a TikTok video.

- Offer Time: Read it. No, seriously, READ IT.

- Cash Dance: Accept and wait for the money to hit your account.

Simple, right? But remember, just because you can microwave a pizza doesn’t mean you should eat it every day.

The Fine Print: Where Dragons Lurk

Let’s talk about what eLoanWarehouse might be whispering instead of shouting:

| Feature | The Nitty-Gritty |

|---|---|

| APR | Could make your eyes water (200% to 500%+) |

| Late Fees | Can pile up faster than laundry |

| Early Payoff | Might cost you extra (yeah, you read that right) |

Real Talk: Is This Your Financial Superhero?

Time for some straight shooting. These loans can be a lifesaver, but they’re more like financial energy drinks – a quick boost that might leave you crashing hard.

Ask yourself:

- Have I turned over every other stone?

- Can I really pay this back without selling a kidney?

- Do I fully grasp all the costs involved?

- Is this for a need, or am I just funding a want?

If you’re shaking your head “no” to any of these, it might be time to reconsider.

Your Financial Future: Not Built on Payday Loans

Look, we’ve all been there – life throws a curveball, and suddenly you’re scrambling for cash. But instead of making eLoanWarehouse your go-to, why not try:

- Emergency Fund Building: Even spare change adds up.

- Credit Score Boosting: Opens doors to less scary loans.

- Budgeting Bootcamp: Know your money inside and out.

Wrapping It Up: Your Money, Your Call

At the end of the day, only you can decide if eLoanWarehouse is your financial friend or foe. They’re not the villain, but they’re not your fairy godmother either.

If you do take the plunge:

- Borrow the bare minimum

- Have a rock-solid payback plan

- Avoid the rollover temptation like the plague

Remember, your financial health is more marathon than sprint. eLoanWarehouse might help you hurdle a obstacle, but it won’t win you the race.

So, what’s it gonna be? Are you ready to take the reins of your financial destiny, or are you gonna let short-term solutions call the shots? The choice is yours, money maestro. Make it a good one!